Want to make your money work harder in 2025? Florida real estate is still one of the best ways to do it. Even with higher interest rates and more cautious lending, smart investors are locking in serious returns by focusing on the right markets and strategies. From Tampa to Jacksonville to South Florida, the opportunity is real. That is, if you know where to look. Keep reading to discover the most profitable real estate investments and how to make them work for you.

Long-Term Florida Rentals for Investors

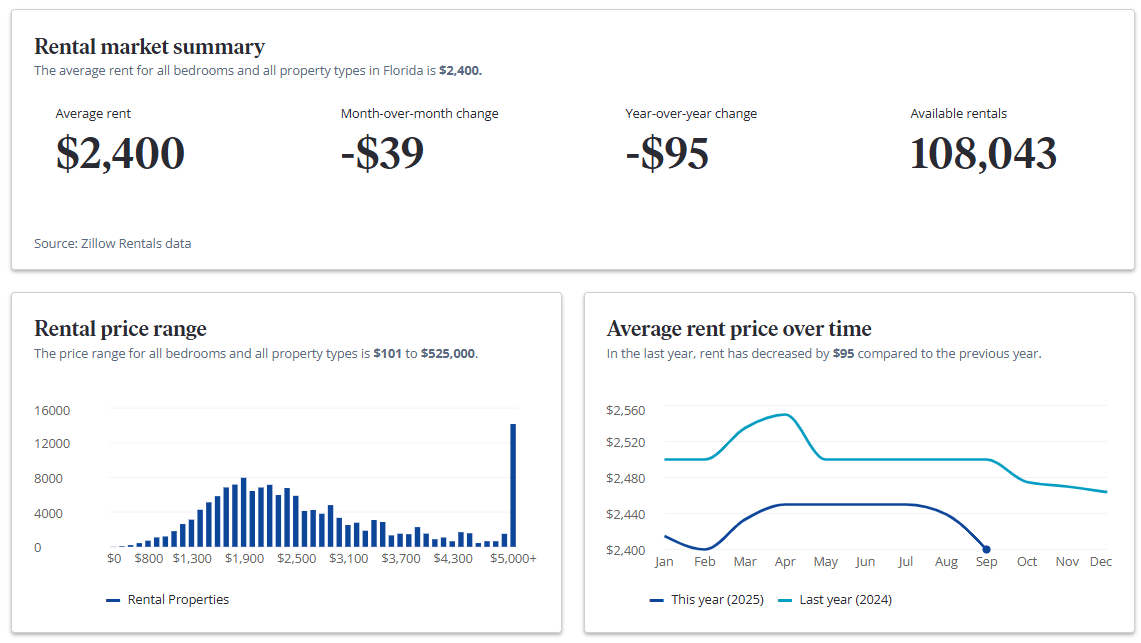

Long-term rental properties continue to be a dependable choice for building cash flow in Florida. In major cities such as Tampa and Jacksonville, more residents are renting due to rising home prices and steady population growth, which has caused Florida rents to surge over 40% in the last four years. Investors who focus on properties near schools, shopping areas, and public transportation are finding consistent tenant demand and fewer vacancies.

Many landlords are boosting income by adding legal accessory dwelling units (ADUs) or converting homes into legal duplexes. This allows for more rental income from the same property without purchasing additional land. This year, renters are looking for well-maintained homes with functional upgrades and flexible lease terms. Investors who meet these needs are seeing above-average returns while keeping their properties occupied year-round.

New legislation that started in July 2025 also gives landlords the option to offer tenants a small non-refundable monthly fee instead of requiring a large upfront security deposit. This can make it easier to fill vacancies and attract renters who may not have thousands of dollars saved, while still protecting the landlord’s interests.

And with Florida’s laws continuing to support landlord rights, long-term rental ownership remains appealing. Property owners can still set their own rent, deposits, and late fees, as rent control is not allowed statewide.

Source: Zillow: Average Rental Price in Florida - September 2025

Short-Term and Mid-Term Rentals in Florida

Short-term vacation rentals are still profitable ventures in real estate across Florida, especially in areas that attract tourists. While some cities like Miami and Sarasota have specific ordinances that regulate short-term rentals, Florida has not moved toward strict statewide restrictions. In 2024, a bill that would have allowed local governments to ban short-term rentals was vetoed. This decision keeps most investor-friendly policies in place, allowing for continued growth in this space.

Neighborhoods near beaches, theme parks, and downtown districts remain popular for vacation renters. Properties that are furnished, professionally cleaned, and marketed on platforms like Airbnb and Vrbo are generating strong occupancy rates. Investors who provide a reliable guest experience and follow local rules are seeing positive returns.

Mid-term rentals are also growing in popularity. These rentals appeal to travel nurses, contract workers, and digital nomads who need a place for one to three months. Properties near hospitals, universities, and business parks are especially in demand. These units often come fully furnished and command higher rates than standard long-term rentals, making them a great way to maximize property investment returns in today’s market.

Fix-and-Flips Still Work With the Right Strategy

Fix-and-flip projects are still profitable for the right investor. While the cost of materials and labor has increased, many homes across Florida still present solid opportunities if you buy carefully and renovate with a clear budget. In cities like Tampa and Orlando, buyers are still looking for updated, move-in-ready homes, especially in neighborhoods close to downtown or in areas with ongoing redevelopment.

Successful investors are focusing on properties that need cosmetic updates rather than full structural work. Kitchen and bathroom improvements, new flooring, and fresh paint are delivering the best return on investment. To protect profits, investors are setting realistic timelines, budgeting for surprises, and working with contractors who understand the local permit process.

Fix-and-flips are still one of the the most profitable real estate investments for investors who want quicker returns. However, the margin for error is smaller than in previous years. Careful planning and conservative budgeting are more important than ever.

Commercial Properties Can Deliver Higher Long-Term Returns

If you're looking to diversify your portfolio, commercial real estate in Florida is still worth a serious look. While traditional office buildings have cooled off in recent years, other commercial spaces are holding steady or even growing. Think neighborhood retail centers, small medical offices, and light industrial properties. These types of buildings tend to come with longer leases and fewer turnover headaches, which means more predictable income over time.

A lot of local investors are focusing on properties that serve everyday needs. Dental offices, shipping centers, and small grocery stores are all examples of tenants that stick around and pay reliably. Properties near new residential developments are especially popular because as more homes get built, the demand for nearby services goes up. Commercial deals do take more money and planning upfront, but they can pay off in a big way. For experienced investors or those ready to scale, these properties are a solid way to earn strong returns in Florida’s evolving market.

Tampa’s Real Estate ROI Opportunities Keep Growing

Tampa is still one of Florida’s most promising markets for investors. The city hits that sweet spot where prices are still reasonable, but demand is growing fast. With more people moving in and ongoing investment in infrastructure, rental properties are holding value and producing solid returns. Neighborhoods like Westchase, Riverview, and Seminole Heights are drawing attention for both appreciation and rental income potential.

There’s also a wide range of investment strategies working in Tampa right now. Investors are finding success with small multifamily homes, mid-term rentals aimed at traveling nurses and remote workers, and even basic townhomes near major employers. Areas close to hospitals, universities, and downtown continue to offer dependable cash flow.

One of the big advantages in Tampa is that the local government remains relatively friendly to property owners. You’re not seeing heavy-handed rental restrictions in most parts of the city, which keeps it attractive for investors looking to apply high ROI real estate strategies without extra red tape. If you're serious about making real estate work for you in 2025, Tampa deserves a spot on your radar.

Get Expert Help Before You Invest in Florida

The Florida real estate market changes quickly. What worked last year may not work this year, and national trends don’t always reflect what’s happening on the ground. At Vreeland Real Estate, we specialize in helping investors make confident, informed decisions backed by real-time local insights. If you're ready to identify the most profitable real estate investments and avoid common mistakes, call us today at (813) 945-4826. Our team will help you analyze options, understand local laws, and negotiate smart deals that support your long-term success.